This is the second installment in a Q&A series with Laura Ann Sweitzer. (Link to the first & third installments at the end!) We did the Q&A over Instagram DM in July 2019 and shared the convo via screenshots. The convo is saved in my Instagram highlights, and the full transcript is below.

Laura Ann Sweitzer is the Director of TCHO Source, TCHO’s unique program for addressing challenges in the cocoa supply chain. Sweitzer also purchases all of the cocoa beans and cocoa products used by TCHO. In addition to working closely with TCHO’s suppliers, Sweitzer focuses on quality and flavor at every step in the sourcing and chocolate making process.

Prior to joining TCHO in 2014, she spent 5 years working on coffee quality improvement projects in Latin America, Africa, and Asia. Sweitzer grew up on a farm in the Midwest and is passionate about sustainability, equity, and flavor in food.

Where We Left Off

LAS: In short, improving quality cannot be the sole answer/advice to the vast majority of cocoa farmers seeking a sustainable price in a volatile commodity market influenced by global supply, global demand, speculation, exchange rates and more.

UM: That completely makes sense. How have some cocoa-producing countries stepped up to address these price issues?

What is a Living Income Differential?

LAS: Last week Ghana and Ivory Coast finalized adding a “Living Income Differential” to every single metric ton of cocoa sold from these two countries – which together account for almost 70 % of world cocoa supply.

UM: That is amazing! Can you tell me more about how the program works?

LAS: A fixed Living Income Differential (LID) of $400 per MT must be paid for every cocoa contract sold by either country for the 2020/2021 season. The LID will be paid in addition to the existing generic country Premiums for beans from each country.

Both governments suspended all sales of cocoa during the development of this agreement- which commanded very attentive and engaged participation from the cocoa sector.

UM: Oh wow! How long was cocoa trade suspended for?

LAS: June 12-July 16, 2019

The suspension was for 2020/2021 contracts. Much of the production is contracted well in advance-so it definitely delayed the cycle. But didn’t create a situation where individual farmers were sitting on product.

UM: Right that totally makes sense. Thank you for that! I’m trying to translate $400/metric ton to a container of cocoa.

LAS: Cocoa generally ships in 25MT containers.

UM: Oh ok thank you! What would be the cocoa equivalent of a bag of coffee?

LAS: The bag weights vary a bit (60-65kg) from country to country. Bags from Ghana are 60.2kg each. I’m not sure of the bag weight in Ivory Coast.

UM: Thank you!

LAS: Here are some of the details on how the $400 LID paid on top of the FOB price will make it to farmers.

UM: Ok amazing, thank you!

LAS: Each country will legislate that the minimum (farm gate) price a farmer can receive for cocoa is $1820/MT. Researchers from Ghana and Ivory Coast calculate this price covers the cost of production + 13% for farmer income.

Both Ghana and Ivory Coast have set a minimum farm gate price for years and this $1820 represents an average price increase of 40% for farmers from Ivory Coast and a 20% increase for farmers from Ghana.

To be able to pay $1820 at farmgate, and cover their own role in the supply chain plus taxes, Ghana and Ivory Coast need to receive an FOB price of $2,600. If the FOB price is $2600- they can pass 70% onto farmers and cover their costs plus taxes with the remaining 30%.

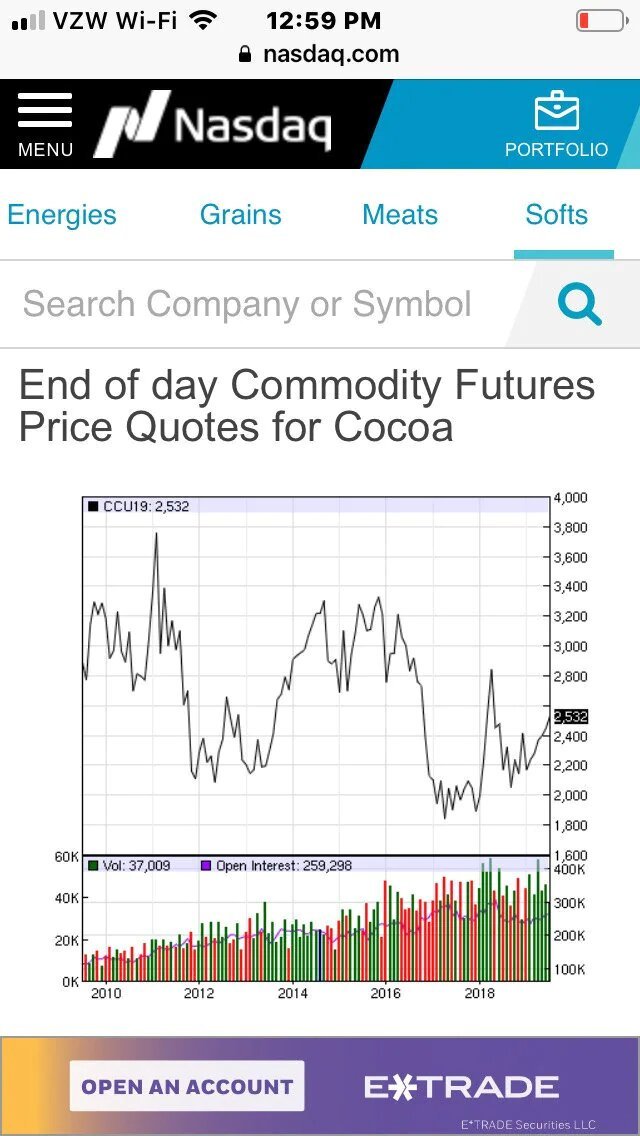

As you can see from this 10 year view, since 2016 cocoa market prices have trended lower. Often below these stated targets.

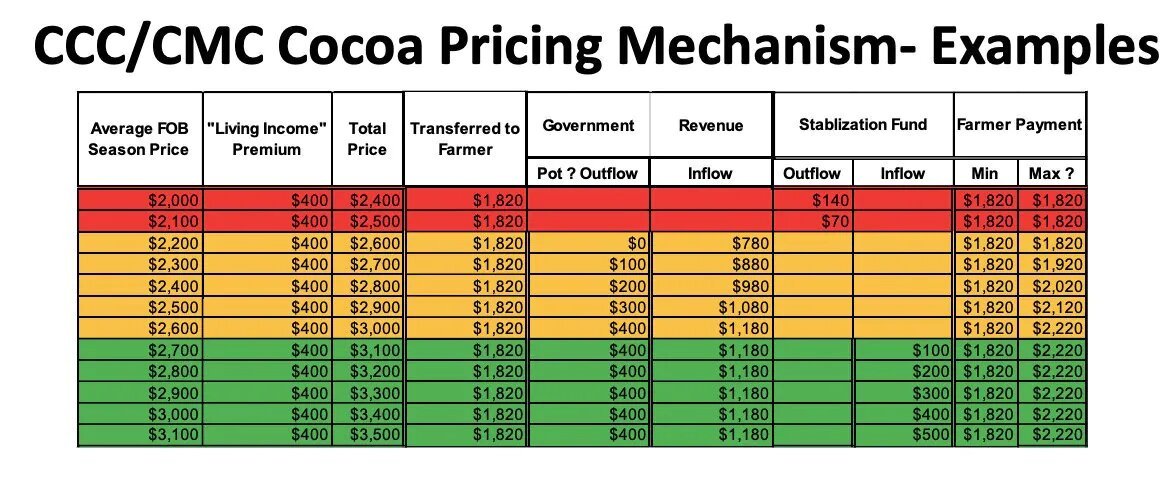

The $400 LID will be paid on top of the FOB price all the time, even when the market is high. There are three “price bands” and the $400 will be used a little different in each band. Here is a graph created by Blommer Chocolate Company that illustrates what happens in each price range:

Under $2,200: When the market FOB price is under $2200 – the $400 LID alone won’t hit the target FOB price of $2600- so the governments will have to cover the gap.

Between $2,200 and $2,600: With an FOB price between $2200 and $2600 the $400 LID can be used to pay the farmers over the minimum price and the governments can also increase their share.

Above $2,700: With FOB prices above $2700 – all additional funds go into a government regulated stabilization fund (each country will maintain their own stabilization fund) to ensure the minimum price when the FOB price is low.

UM: Wow this is a lot of information! I have a few questions if that’s ok 🙂

LAS: It is a lot! Yes please with the questions.

UM: I wanted to touch on the FOB vs farmgate price. You mentioned that the $2600 FOB allows farmers to take 70% ($1820) per metric ton. The remaining 30% you mentioned goes to cover costs and fees.

Who are the actors here besides the farmer? And if the 30% FOB only covers costs and fees, where are they getting their margin?

LAS: The government is the selling entity (the Conseil du Café-Cacao in Ivory Coast and the Cocoa Marketing Company of the Ghana Cocoa Board in Ghana)

The government structures and the role of private actors differ between the two countries, but the 30% covers the governments costs (transportation, warehousing, admin) but also includes the taxes- which is their margin.

UM: Interesting! In Ghana / Ivory Coast, are there no private cocoa exporters?

LAS: My understanding is both countries are a public/private hybrid. The Ghana Cocoa Board- COCOBOD is the sole exporter of cocoa beans from Ghana. Several private exporters have permits to export cocoa products (ie cocoa powder, cocoa butter) that are manufactured in Ghana. And private actors (licensed buying companies – LBCs) assist in the purchase of cocoa beans from farmers and internal transportation in Ghana.

TCHO doesn’t source from Ivory Coast – so if it’s ok I’ll just explain using Ghana as the example.

UM: Ok of course!

So here are my takeaways on this initiative – am I getting this right?

Ghana has established a minimum farmgate price: $1820 / metric ton (this farmgate price covers CoP + 13% margin for farmer).

This is minimum $1820 farmgate price is a 40% increase for Ghana & Ivory Coast farmers and a 20% increase for Ghana farmers.

The $1820 farmgate price necessitates an FOB price of $2600. With that FOB, 70% can go to farmers while the remaining 30% covers costs plus taxes.

LAS: Your takeaways are spot on. One clarification- there is only a minimum farm gate price ($1820/MT) – which will be legislated into law. There is not a minimum FOB price.

UM: That’s a super helpful clarification, thank you! So there’s a minimum farmgate but the FOB is a target (not legislated)?

LAS: The FOB price will continue to move with the market.

UM: Ok got it. That makes sense, thank you!

LAS: Moving on to the LID measure, can you let me know if I’m getting this?

LAS: Yes – for sure.

UM: Ok so the LID ($400/ metric ton) is paid by cocoa buyers to the government exporting body?

LAS: Yes! And the LID will also be accessed on internal sale to factories in Ghana and Ivory Coast. So no getting around the additional $400 for cocoa buyers, even with in country processing 🙂

UM: Ok so it’s basically like – a rainy day fund for to cover for market lows, it’s maintained by the government, and it’s funded by cocoa buyers every time they purchase cocoa?

Then when the market is low and FOBs drop below $2200 (keeping in mind target FOB is $2600), government draws from the LID to covers the gap for farmers.

LAS: Yes that’s how the stabilization fund will work. It will be filled when the FOB price (before adding the LID) is higher than $2,600 and depleted to guarantee the minimum farm gate price when the FOB price (before adding the LID) is below $2,200.

UM: Ok got it! One thing I really admire about this is …

Stay tuned for more, coming soon in the next blog post!

The first installment in this series here.

The third installment is here.

TCHO Chocolate is online at tcho.comand Instagram at @tchochocolate

Umeshiso is on Instagram at @umeshiso_